Unlocking the intricacies of personal finance, Foundations in Personal Finance Chapter 8 Answer Key PDF empowers individuals with the knowledge and strategies to navigate financial decision-making with confidence. This comprehensive guide provides an in-depth exploration of key concepts, enabling readers to establish a solid foundation for financial well-being.

Delving into budgeting, cash flow management, saving, investing, credit, insurance, and retirement planning, this chapter offers practical guidance and actionable insights. By mastering the principles Artikeld in this answer key, individuals can effectively manage their finances, achieve financial goals, and secure their financial future.

Understanding Personal Finance Fundamentals

Financial literacy is essential for managing your money wisely. It empowers you to make informed decisions, avoid costly mistakes, and achieve your financial goals. The key principles of personal finance include budgeting, saving, investing, managing debt, and planning for the future.

Common financial mistakes include overspending, not saving enough, taking on too much debt, and failing to plan for retirement. Avoiding these mistakes can help you build a strong financial foundation.

Budgeting and Cash Flow Management

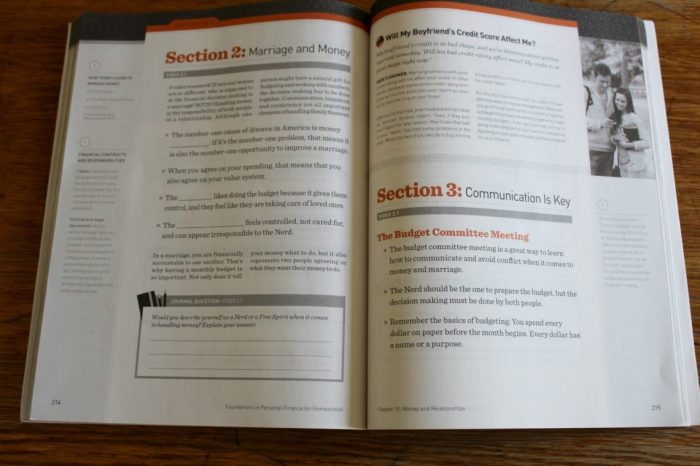

Creating a budget is crucial for tracking your income and expenses. There are various budgeting methods, such as the 50/30/20 rule, the zero-based budget, and the envelope system. Tracking expenses can be done through apps, spreadsheets, or simply writing them down.

Reducing unnecessary spending requires identifying areas where you can cut back. Consider using coupons, negotiating bills, and avoiding impulse purchases.

Saving and Investing for the Future

Saving money is essential for building an emergency fund, reaching financial goals, and securing your future. There are different types of savings accounts, such as checking accounts, savings accounts, and money market accounts.

Investing is a way to grow your money over time. There are various investment options, including stocks, bonds, mutual funds, and real estate. Compound interest is a powerful tool that can significantly increase your savings over time.

Credit and Debt Management

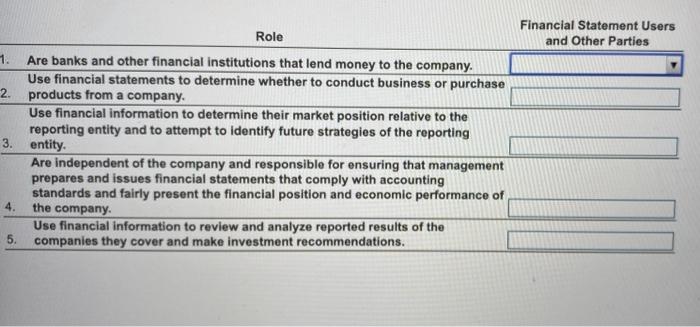

Credit is a tool that can be used to finance purchases or cover expenses. Different types of credit include credit cards, personal loans, and mortgages. Your credit score is a measure of your creditworthiness, and it affects your ability to obtain credit and the interest rates you pay.

Managing debt effectively involves making timely payments, paying off high-interest debts first, and consolidating debts if possible.

Insurance and Risk Management, Foundations in personal finance chapter 8 answer key pdf

Insurance is a way to protect yourself from financial losses in the event of an accident, illness, or other unexpected events. Different types of insurance include health insurance, life insurance, disability insurance, and property insurance.

Risk management involves identifying and mitigating potential financial risks. Strategies include diversifying investments, maintaining an emergency fund, and having adequate insurance coverage.

Retirement Planning

Retirement planning should start early. It involves estimating your retirement expenses, setting savings goals, and choosing retirement savings options. There are different types of retirement accounts, such as 401(k) plans, IRAs, and annuities.

Estate Planning

Estate planning is essential for ensuring that your wishes are carried out after your death. It involves creating a will, appointing an executor, and distributing your assets. An estate plan can help avoid probate and minimize taxes.

Answers to Common Questions: Foundations In Personal Finance Chapter 8 Answer Key Pdf

What is the significance of budgeting in personal finance?

Budgeting is crucial for gaining control over your finances. It allows you to track income and expenses, identify areas for improvement, and make informed decisions about resource allocation.

How does compound interest impact saving and investing?

Compound interest is the interest earned on both the principal amount and the accumulated interest. Over time, this exponential growth can significantly increase the value of savings and investments.

What are the key factors that affect credit scores?

Credit scores are influenced by factors such as payment history, credit utilization ratio, length of credit history, and new credit inquiries. Maintaining a positive credit score is essential for accessing favorable loan terms and interest rates.